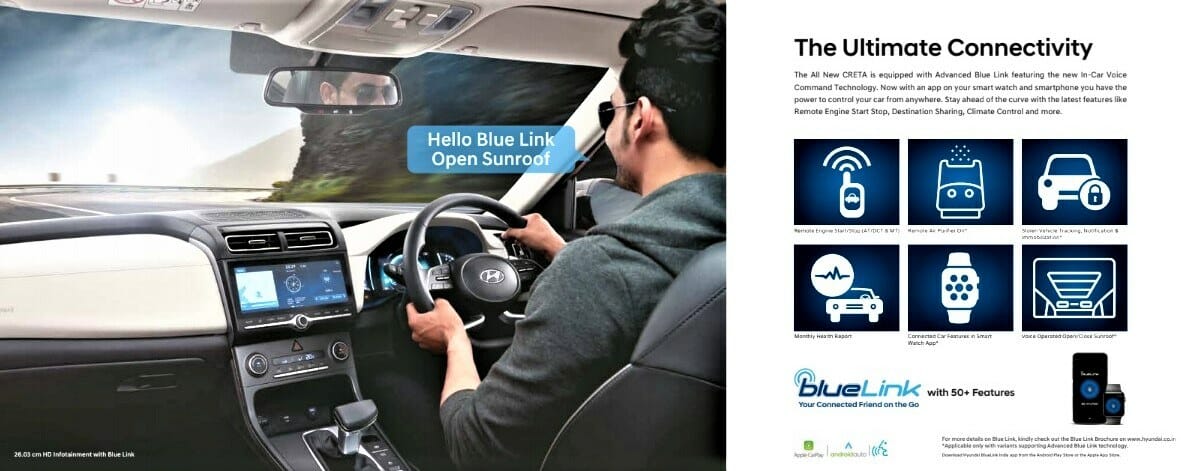

Connected cars and their features are big selling points these days. Almost every new car out there now has a sim card of its own, is connected to the internet, or at least allows the user’s cell phone to be paired with the vehicle’s system.

But those who buy these vehicles, are they actually using everything that’s been offered? Because mind you, most manufacturers offer these services as a part of the initial cost, only for a certain duration. Post that, one has to pay a subscription fee for their cars to still be connected.

According to a Capgemini report, Original equipment manufacturers (OEMs) have an opportunity to exploit the full potential of connected services but must act quickly as the gap between them and digital players widens. This is based on a new research report from Capgemini Invent exploring the road towards profitability for automotive connected services.

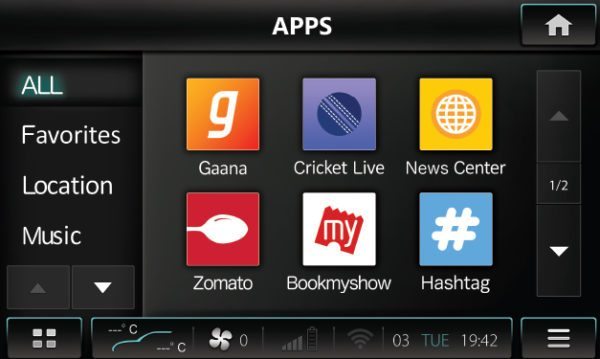

The ‘Connected Vehicle Trend Radar 2’, which surveyed over 3,000 customers worldwide, found that close to half (44%) of global customers do not yet have any connected services in their cars and only 51% of those that do are frequent users, meaning OEMs have yet to penetrate the connected services market effectively. The findings suggest, that opening up the connected services portfolio to include third-party applications would be a way for manufacturers to regain top position against their digital native counterparts: according to the report, people are already using third-party applications from major tech players, so making these accessible through their vehicle’s interface is key to bringing customers, and their data, back into the fold.

Key Highlights from the report:

- Capgemini Invent in its report – Connected Vehicle Trend Radar, explores how OEMs can make the most of connected services in terms of monetization

- 3,000 customers worldwide were surveyed to find out their views on current services along with a series of expert interviews to interpret the findings

- The research shows that OEMs have yet to exploit the full potential of connectivity. Usage of OEM-provided connected services is generally low – 44% of customers do not yet have any connected services in their cars, and only about half of those who do have them are frequent users

- OEMs have yet to penetrate the connected services market effectively. Unlike traditional OEMs, Tesla has strong brand awareness for connected services, holding the #1 position in the EU, the US, and China, and continues to reinforce its lead over traditional OEMs in this area.

- With smartphones heavily used in cars, technology companies such as Google and Apple could gain control of the customer interface. As a result, they are losing the pole position for connected services and, more seriously, starting to lose customers’ loyalty too. They risk missing out on revenue and, at worst, ending up as suppliers to tech companies.

- OEM that wants to regain a leadership position in connected services must address three revenue streams:

- ACTING AS A PROVIDER OF VALUABLE SERVICES IN ITS OWN RIGHT

- INTEGRATION OF NECESSARY THIRD-PARTY SERVICES

- MONETIZATION OF DATA GATHERED

- Data monetization has the greatest long-term profit potential, the other two streams have to be tackled first to attract the critical mass of users – and frequent usage – required for data monetization

The potential of connected vehicles for the industry is clear. The number of connected cars is set to increase to 352 million by 2023, and this growth is expected to be associated with a rapid proliferation of data, from 33 zettabytes in 2018 to 175 zettabytes in 2025 – data that can be monetized by OEMs. However, this data growth depends on customer take-up of connected services. Around 44% of customers do not yet have any connected services in their cars, and only about half of those that do have connected services use them frequently. 51% of customers use their connected car services frequently

- Best OEM for connected services – respondents in all regions mentioned Tesla as Number 1, followed by BMW and Mercedes

- OEMs are good at making cars and at optimizing the associated supply chains. They have tended to outsource activities outside their core competencies, including most software and electronic control unit (ECU) components. Understandably, they have applied a similar approach to connected services, with services and data mostly sourced from third parties, collected within the backend of OEMs and integrated into the vehicles’ head units. While services have been given a seamless look-and-feel over time, they cannot usually be updated after the car is on the road. Worse, the services available vary widely from model to model within a given OEM’s range

- For OEMs who regard connected services as a strategic revenue source, we suggest viewing customers primarily as an asset for the future rather than a profit pool for today – Service Provision, Service Integration and Data Monetisation

Sustainability & Connected Car

- 56% of global customers surveyed and 47% of European Customers consider sustainable connected services in their purchase or leasing decision

- 54% of Generation Y global customers surveyed (vs. 26% Baby Boomers) would change car brands even if sustainable connected services cost more

- 53% of global customers surveyed and 42% of European Customers surveyed are willing to change car brands if they know that the other brand offers sustainable connected services

- 77% of the Chinese customers surveyed and 44% of European customers surveyed would pay more for sustainable connected services than for “traditional” ones

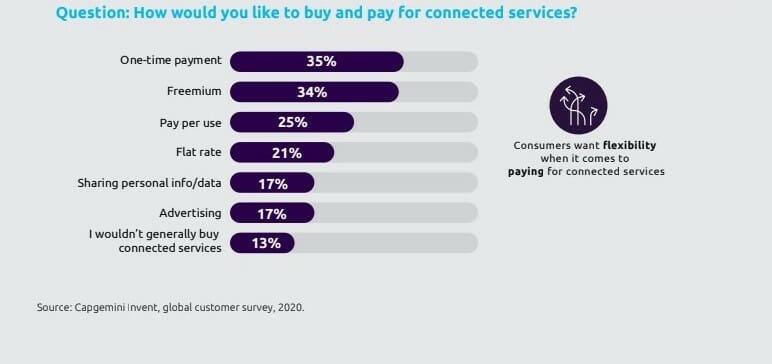

Pricing and Sales Strategy

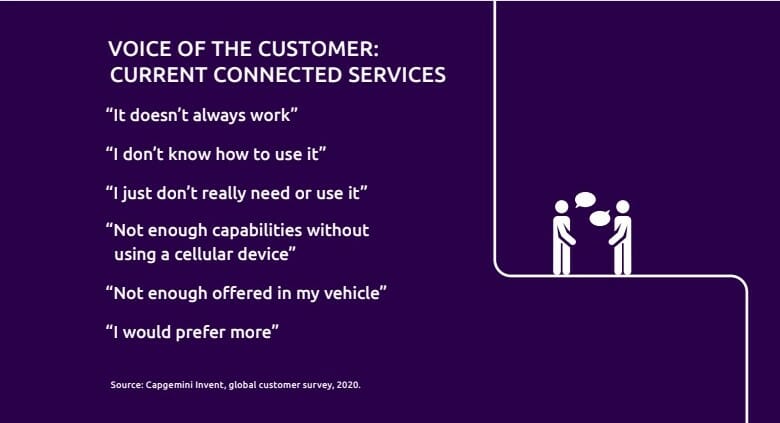

- Consumer willingness to pay for these connected services is relatively low in all categories – 39% of consumers stated that services are useful but not sufficiently developed, while another 23% were unaware of their benefit41% of global respondents in the survey said that services currently offered are too expensive

- 61% of respondents want to be able to purchase connected services at any time, 71% would like to be able to decide on individual services or packages, and 69% would like to be able to choose between different versions, e.g. basic or premium connected services

Talking about the report, Dr Rainer Mehl, Managing Director of Manufacturing, Automotive, and Life Sciences at Capgemini Invent, explains: “Manufacturers today are burdened by legacy and tend to assume that connected services can be delivered in exactly the same way that cars are produced — by simply assembling elements from suppliers instead of working as part of an ecosystem with best-in-class partners. But losing market share in connected services means missed revenue, or worse, potentially becoming a supplier to tech companies.”

The report also states that traditional manufacturers need to ensure they are targeting consumers with the services they want: out of 23 use case categories investigated in the report, safety and security-related services are valued most while in-car delivery and commerce the least. Current consumer willingness to pay for these connected services is relatively low in all categories – 39% of consumers stated that services are useful but not sufficiently developed, while another 23% were unaware of their benefits. Education will therefore play a big role in making connected tools a unique selling point.

According to the report, connected services don’t just offer a wide range of untapped opportunities for traditional auto players — they’re critical. Digital players have recognized that a car is just another entity in a consumer’s digital environment. In order to boost customer loyalty, the driving experience needs to merge seamlessly into a person’s digital life. Before, the relationship between manufacturer and consumer was rarely as strong post-purchase, but now users are increasingly becoming a manufacturer’s strongest asset for the future. This requires OEMs to act quickly to provide services that customers value and use.

Harpin on the need for OEMs to establish their place in the connectivity ecosystem, the report says that OEMs typically outsource activities that are beyond their core competencies and have applied a similar approach to connectivity. While these connected services have been given a seamless look and feel over time, they cannot usually be updated once the car is on the road; worse, the services currently available vary widely from model to model within a given OEM’s range. Adding to his comments, Mr Rainer said, “In the past, drivers had to make do with what they were given by manufacturers, but this monopoly no longer exists. Tech companies successfully entered the space with smartphone services and easy connections towards the car. Now, OEMs need to work harder to stay relevant — especially as customers become increasingly unwilling to accept connected services that are not current or fall short of the premium.”