Maruti Suzuki Smart Finance has hit a big milestone. The company has crossed 2.5 million car loan disbursals since the platform started in 2020. When you come to the numbers, that adds up to over Rs 1,70,000 crore as car loans. It’s a massive number, and it clearly shows how most people now prefer handling their car finance online instead of dealing with the old, slow process.

The idea of Maruti Suzuki Smart Finance was simple from the very beginning: make the whole loan process easier. Earlier, the buyers had to check on the interest rates, compare banks, fill out different forms, and visit the branches. With this platform, Maruti Suzuki wanted everything to be available under one roof.

A few details stand out:

- The platform is currently made up of 35 finance partners.

- Works across ARENA and NEXA customers

- Fully digital steps from start to finish

- Tracking of the loan status in real-time

- Options available for both salaried and self-employed buyers

The company says it has more than 40% of its customers opting to take their loan through this platform. That means almost half the buyers prefer managing everything from their phone or laptop before even reaching the dealership.

Maruti Suzuki’s Senior Executive Officer for Marketing and Sales, Mr. Partho Banerjee, said,

“Today, most car buyers start their journey online, exploring models and

financing options before visiting a dealership. Recognising the magnitude of this shift early on, Maruti

Suzuki pioneered a multi-financier, end-to-end digital car financing solution with Maruti Suzuki Smart

Finance. Over the past five years, this platform has transformed the car-buying experience. Over 40% of

our customers availed loans through Maruti Suzuki Smart Finance across ARENA and NEXA. MSSF’s

‘anytime-anywhere’ convenience has provided Joy of Mobility to over 2.5 million customers, amounting to more than ₹1,70,000 crore, reflecting our commitment to innovation and customer delight.”

“This success is powered by the unwavering support of our finance partners, enabling seamless financing nationwide. Together, we continue to redefine automotive retail through

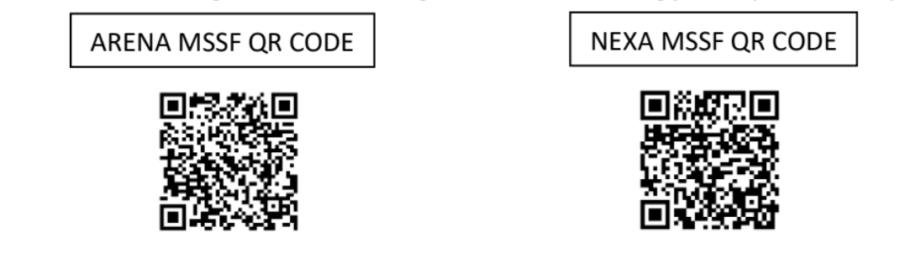

The platform offers services like credit-score-based interest rates and even pre-approved loan options. It also allows customers to compare offers from different financiers side by side, making choosing easier. For convenience, QR codes for both ARENA and NEXA have also been placed across outlets so that people can simply scan and begin their loan journey instantly.

This milestone shows how quickly people are shifting to digital methods, especially for something as important as a car loan. Smart Finance seems to have made the process quicker and simpler, letting customers handle everything at their own pace and from wherever they are.