New-vehicle owners in India want features and technologies that aid in driving convenience and visibility and safety, according to the J.D. Power Asia Pacific 2014 India Automotive Performance, Execution and Layout (APEAL) StudySM released today. The India APEAL Study, now in its 16th year, serves as the industry benchmark for new-vehicle appeal. The APEAL Study, which examines how gratifying a new vehicle is to own and drive, is used extensively by manufacturers worldwide to help them design and develop more appealing vehicles and by consumers to help them in their purchase decisions.

The study measures satisfaction across 10 performance categories: vehicle exterior; vehicle interior; storage and space; audio/ entertainment/ navigation; seats; heating, ventilation and air conditioning (HVAC); driving dynamics; engine/ transmission; visibility and driving safety; and fuel economy. Overall APEAL performance is reported as an index score based on a 1,000-point scale, with a higher score indicating higher satisfaction. Visibility and driving safety is the most influential performance category on new-vehicle customer satisfaction in the small car market, contributing 16 percent to the overall APEAL score, and is the third-most impactful category in the midsize segment, where it contributes 13 percent to overall satisfaction.

The table below shows the percentage of small-car owners that “want” the listed safety feature on their next new vehicle and the percentage of small-car owners who already “have” the feature on their current vehicle.

| Safety Feature | Demand –Percentage of small-car owners that “want” this feature | Current Installation Rates –Percentage of small-car owners that “have” this feature |

| Height adjustable driver’s seat | 95% | 35% |

| Anti-lock braking system | 94% | 24% |

| Parking assist/sensor | 93% | 12% |

| Hands-free communication | 93% | 10% |

| Steering wheel mounted audio controls | 92% | 17% |

| Airbags | 92% | 12% |

| Rear window wiper | 91% | 21% |

“The rapid and substantial increase in demand for safety features by vehicle buyers in India over the last few years underscores the need for automakers to develop innovative and cost-effective solutions to address customer expectations,” said Mohit Arora, executive director at J.D. Power Asia Pacific, Singapore. “While India shows interest in some of these basic safety features, globally, there is a growing interest in a variety of more advanced vehicle safety features. In developed markets, such as the U.S., we are seeing a rising demand for emerging safety technologies such as low speed collision avoidance systems and fully autonomous parking systems.”

In addition to safety features, owners also value driving convenience. For example, while automatic transmissions are currently found in only 5 percent of the new vehicles sold in India, 82 percent of owners want the option in their next vehicle. APEAL scores among mass market vehicles equipped with an automatic transmission average 869, compared with 854 among mass market vehicles with manual transmissions.

“According to the study data, new-vehicle owners spend nearly 2 hours commuting each day, on average, which is almost a 15 percent increase from 2011. With the addition of more than 2.5 million passenger vehicles to the roads in India in 2013, average commute time is expected to further increase, supporting customers’ demand for technologies and features that make the overall driving experience safer and less strenuous,” said Arora.

KEY FINDINGS

- The overall vehicle APEAL score averages 854 in 2014, up from 845 in 2013.

- APEAL scores for newly launched models averages 855, compared with 854 for carry-over models in 2014. In 2013, APEAL scores for all-new models were 9 points higher than for existing models (852 vs. 843, respectively).

- In the fuel economy performance category, satisfaction for carry-over models averages 846, compared to 838 for all-new models. The lower scores for all-new models is partially attributed to higher expectations on fuel efficiency among new-vehicle owners, as the average price for petrol has increased nearly 56 percent and diesel nearly 72 percent in the past five years.

- Automakers/Dealers are also overpromising on fuel-efficiency, as actual fuel economy is 23 percent lower than the average fuel economy owners were promised during the sales process.

Model Results by Segment

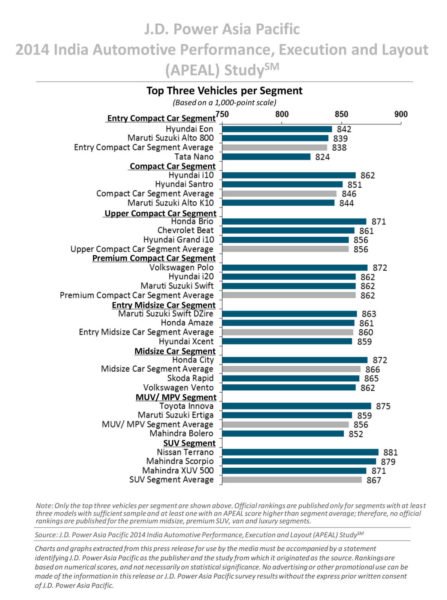

Both Honda and Hyundai receive two segment awards each: Honda for the Brio (upper compact car) and City (midsize car); and Hyundai for the Eon (entry compact car) and i10 (compact car).

Other models receiving segment awards are the Maruti Suzuki Swift DZire (entry midsize car); Nissan Terrano (SUV); Toyota Innova (MUV/ MPV); and Volkswagen Polo (premium compact car).

The Brio, i10 and Innova also rank highest in their respective segments in the J.D. Power Asia Pacific 2014 India Initial Quality StudySM (IQS).

The 2014 India APEAL Study is based on responses from 8,422 owners who purchased a new vehicle between November 2013 and July 2014. The study was fielded between May and September 2014 in 30 cities across India.