We have been saying this ever since we launched Motoroids2. The auto industry in India prefers to turn a blind eye, for some weird reason. But the truth is, that the internet is the most influential medium when it comes to car buying. Capgemini, one of the leading global consultants, who provide their services to 14 out of the 15 largest automakers of the world, have substantiated the bare truth with the findings of their latest survey. Cars Online 09/10 – Capgemini’s 11th global automotive study has declared that it’ll be foolish on automakers’ part to discount the powerhouse that the internet is. Seems like it’s high time for the Indian automotive industry from their long slumber and give the Internet its due, failing which, they are sure to lose a lot. Here’s a brief log of the findings of the survey.

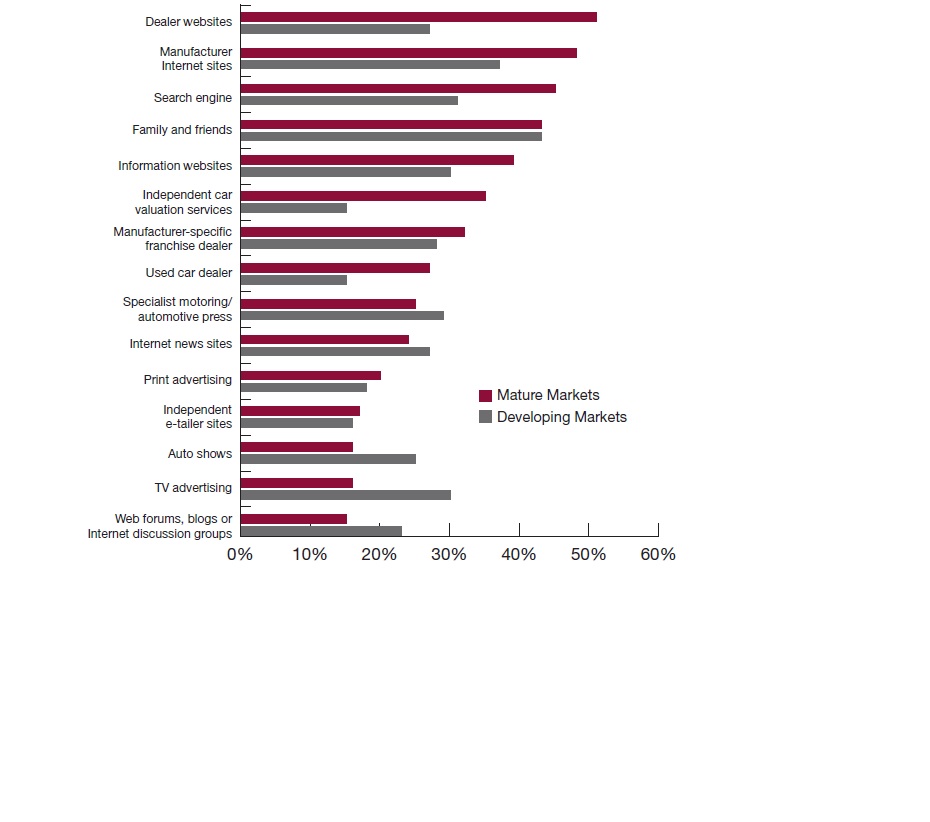

- Usage of the web as a key information source during the vehicle buying process has become pervasive across most markets. Almost 90% of consumers today use the Internet to research vehicles, up from 61% in 2005. A clear online usage pattern has emerged, with consumers turning initially to search engines, which jumped up the list of information sources this year; then to manufacturer and dealer sites for factual information about vehicles, prices and availability; and finally to consumer-to-consumer tools like discussion sites for qualitative information and opinions.

- Consumers want to buy vehicles and parts and accessories online as they look for lower prices and an alternative to the traditional dealer model. Nearly 40% of respondents said they would like to buy a car over the Internet (the complete end-to-end process) and half would buy parts and accessories. While lower price is the leading reason, many respondents said they simply did not want to negotiate price or interact with the dealer in person. Consumers seem to be polarized in their desire to negotiate: about one

- Green vehicle ownership continues to rise as environmental concerns grow. Consumers indicate a growing confidence in their understanding of so-called “green” vehicles. This increased knowledge is influencing buying decisions. In this year’s study, 41% of consumers said they currently own a fuel-efficient or alternative-fuel vehicle, up from 36% the year before. Another 30% said they plan to buy a fuel-efficient or alternative-fuel vehicle.

- Improvements in brand and dealer loyalty and overall satisfaction with the buying process bode well for the industry. With plenty of bad news for automotive companies these days, the research uncovered a bit of good news. More than two-thirds of respondents said they were likely to purchase the same make/brand as their current vehicle, up from 61% last year.

- Developing markets show early signs of trending toward mature markets, as consumers in the BRIC countries become more familiar with buying cars. For example, this year the gap between the factors that impact vehicle decisions in mature vs. developing markets was much smaller. Greater convergence will likely still take a number of years, and market differences will remain for some time

- As the duration of the vehicle buying cycle contracts, automotive companies have less time to influence purchases. Consumers today can quickly and easily get vast amounts of informationabout the vehicles they are interested in, resulting in a shrinking buying cycle. What used to take six months is now likely to take only four, with showroom visits coming ever closer to the point of purchase. More than twothirds of respondents begin the research process two to four months before they plan to buy and 60% visit the showroom for the first time within two months of purchase.

- Consumers want the car buying process to be easier and faster. A number of indicators point to a growing desire for improved ease and speed of transaction.

- Less than half of consumers with cars still in-warranty have their vehicles serviced at the purchasing dealership. This represents a significant missed aftersales opportunity for dealers.And it may also impact repurchase decisions, as consumers tend to be more likely to buy their next vehicle from the servicing dealer rather than the prior purchasing dealer.

The writing is on the wall. Car and bike makers worldwide are focusing increasingly on the web. In some cases, the ad spend of some of the european countries on the Internet has surpassed their spend on TV and print. Surprisingly, our domestic industry still thinks that web is too ‘new’ a technology for them to embrace. All we can do is wish them luck!