One Country, one tax. That’s the motive behind implementing the new GST regime, which already has made car manufacturers revise prices of their products. While the price correction has made a majority of models cheaper, only a handful products have come under a slab which makes them slightly more expensive. Only slightly. But if you think that the implementation of GST will result in reduced on-road prices of vehicles, think again. Concerns are now mounting that State Governments will look to raise the Road Tax to offset revenue loss after several local body taxes have been abolished and merged with GST.

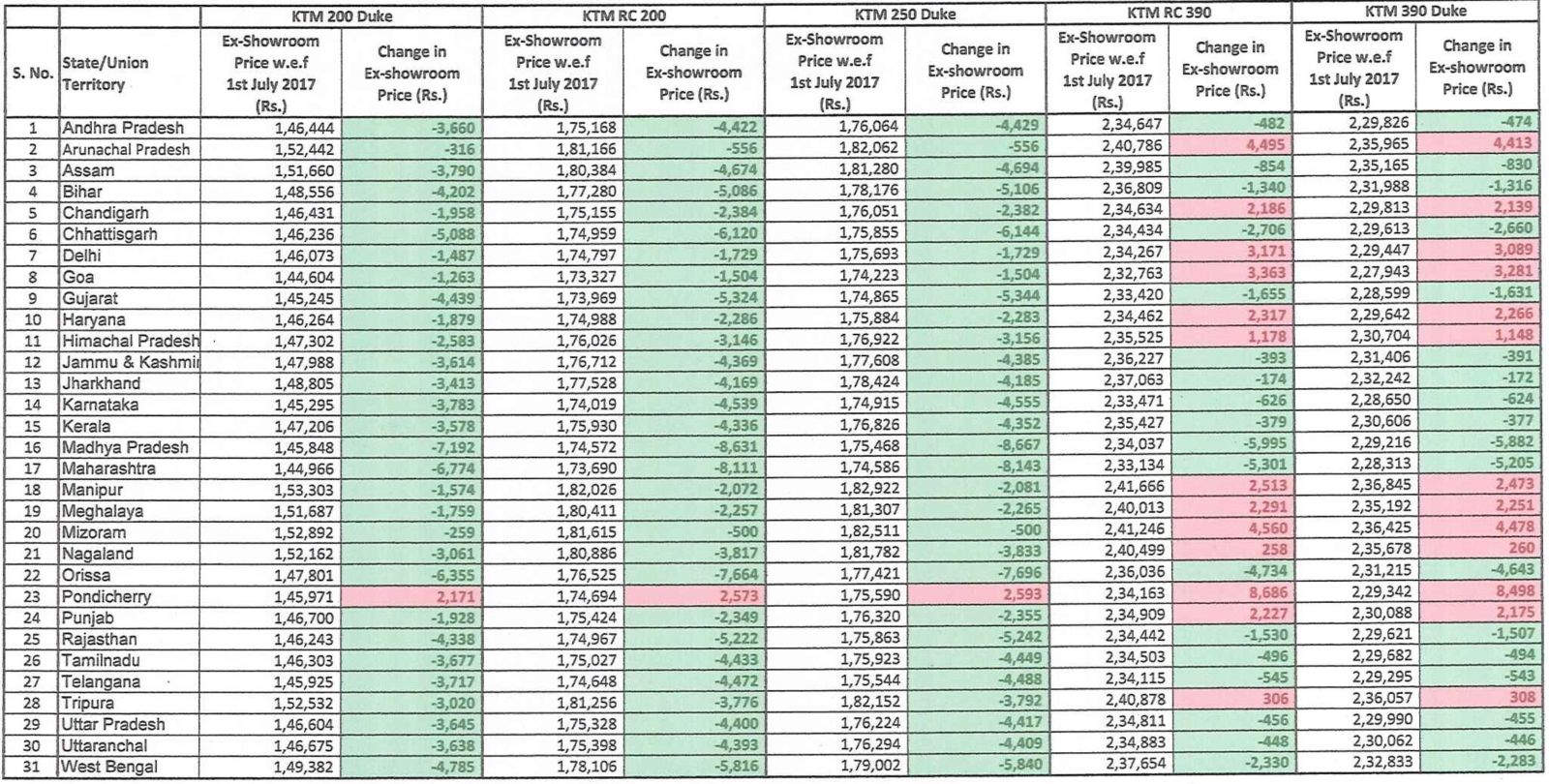

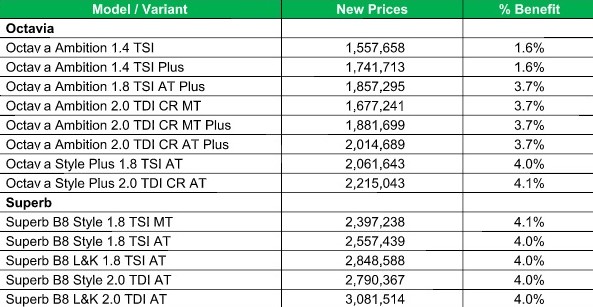

After the new tax regime came into effect on July 1st, 2017, Automakers were quick to pass on the benefits to the end customer, hoping that it would boost sales in a month like July, when sales numbers are historically lean. However, the state levied Road Tax, which isn’t included in GST, looks to pour cold water on the efforts of the Central Government. In Maharashtra, the state cabinet on Tuesday approved a 2% hike in one-time vehicle registration tax on private two-wheelers and four-wheelers. There is already a 2% road safety cess on the tax collected at registration. The state government has held that since it will lose Rs 700 crore per annum on foregoing octroi and other local body taxes on vehicles under GST, it decided to hike the road tax which will generate an extra Rs 750 crore.

Anticipating this situation long before the implementation of GST, Industry executives had even demanded the central government to include road tax in the GST framework. Explaining how state levied road tax will dilute the purpose of GST, Sugato Sen, deputy director general at the Society of Indian Automobile Manufacturers, said, “In the past too, every time the central government lowered excise duty, state governments increased road tax negating the benefit. That is why we had urged the government to subsume road tax in GST. Road tax was originally levied as a user charge, but now it has become a source of generating revenue every time there is some deficit. We talk of one tax, one country, but still, we have road tax varying as widely as 4% to 17% across different states. Consumers would still have to shell out different prices for purchasing vehicles in different states.”

Post the increase, the road tax on petrol cars in Maharashtra will be in the range of 11-13%, while on diesel cars it will be 13-15% and on two-wheelers, 10-12%. The tax, though, has been capped at Rs 20 lakh to ensure that high-end luxury vehicles are not taken outside the state for registration

With inputs from ET