Luxury automakers in India are not doing enough to during the sales experience to significantly differentiate themselves from the mass-market automakers, according to the J.D. Power Asia Pacific 2013 India Sales Satisfaction Index (SSI) StudySM released today.

The study, which for the first time measures sales satisfaction separately in two vehicle segments—luxury and mass market—examines seven factors that contribute to new-vehicle buyers’ overall satisfaction with their sales experience (listed in order of importance): delivery process; delivery timing; salesperson; sales initiation dealer facility; paperwork; and deal. Study findings for the mass market segment were announced in late August.

The luxury vehicle market in India has grown in recent years, with sales expected to reach 26,000 units in 2013 and increase to 84,000 units by 2020, according to LMC Automotive.

“An increase in the number of luxury models available in India, coupled with attractive financial options that enhance affordability, have really helped the luxury market grow,” said Arora. “With that growth comes added pressure for the luxury brands to differentiate themselves from the mass market brands.”

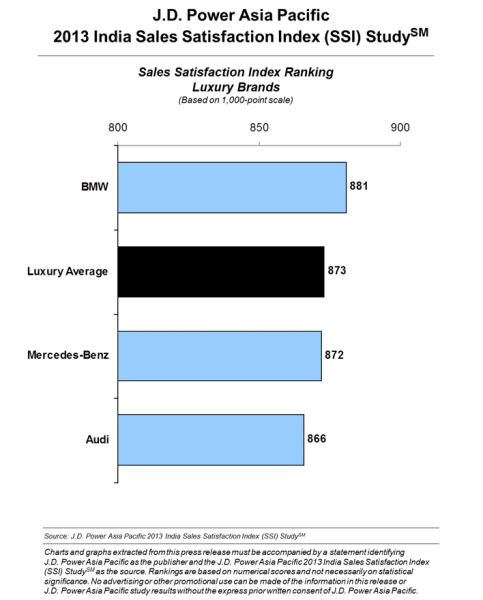

Overall sales satisfaction in the luxury segment averages 873 index points on a 1,000-point scale, 32 points higher than the mass market average. However, satisfaction among luxury vehicle buyers whose overall sales experience only met their expectations is not significantly different than those among mass-market buyers (842 vs. 834, respectively).

“With customers paying much more for a luxury vehicle, they likely have higher expectations during the sales process,” said Arora. “Even when their expectations are being met, it is surprising that their satisfaction is not significantly higher than mass-market vehicle buyers’ satisfaction.”

BMW ranks highest among luxury brands in sales satisfaction in India with a score of 881. BMW performs particularly well in the dealer facility, sales initiation and salesperson factors.

The study finds that adherence to a comprehensive and consistent implementation of 18 sales standards among salespersons has a direct impact on satisfaction for all luxury vehicle buyers. Vehicle buyers expect all 18 sales processes to be implemented in order to mitigate dissatisfaction. This is in contrast to the mass-market segment, where implementation of at least 15 processes is able to derive positive impact on overall purchase satisfaction.

“The price of luxury vehicles is significantly higher than the price of mass market vehicles, and customers expect luxury brands to provide a truly differentiated experience to enhance the value of ownership of these vehicles,” said Mohit Arora, executive director J.D. Power Asia Pacific. “The current network does not provide enough differentiation from the mass market brands to be able to reinforce the premium image of luxury brands.”

The study also finds key differences in new-vehicle shopping behavior between the luxury and mass market segments. Key drivers of luxury-vehicle purchases are overall vehicle performance and safety, while drivers of mass market-vehicle purchases are brand reputation and reliability. Luxury-vehicle buyers are more likely to use the Internet during their shopping process, with 34 percent going online to search for vehicle features and specifications, compared with 28 percent of mass market-vehicle buyers. More than two-thirds (68%) of luxury buyers have two or more vehicles in their household. Additionally, 93 percent of luxury-vehicle buyers opt to finance their purchase, compared with 72 percent of mass market-vehicle buyers.

“Purchasing a luxury vehicle is an expression of achieving the pinnacle of social progress in India,” said Arora. “With more than two-thirds of luxury-vehicle buyers having previous buying experiences with other vehicles, automakers need to personalize the entire purchase experience based on individual buyer expectations in order to truly delight these new-vehicle shoppers.”

Vehicle owners who are highly satisfied with their overall purchase experience have higher levels of advocacy and loyalty toward both the dealership and brand, compared with highly dissatisfied owners. Among owners who are highly satisfied with their purchase experience at the dealership (overall satisfaction scores of 965 and higher), 99 percent say they “definitely will” recommend their purchase dealer to a friend or relative and 94 percent indicate they are likely to repurchase the same brand in the future. In contrast, 54 percent of highly dissatisfied owners (overall satisfaction scores of 803 and below) say they “definitely will” recommend their dealer, and 52 percent indicate they are likely to repurchase the same brand in the future.

The 2013 India Sales Satisfaction Index (SSI) Study for the luxury brands is based on responses from 253 new-vehicle owners who purchased their vehicle between September 2012 and April 2013. The study was fielded from March to July 2013.