4-Point Overview – What May 2025 Revealed

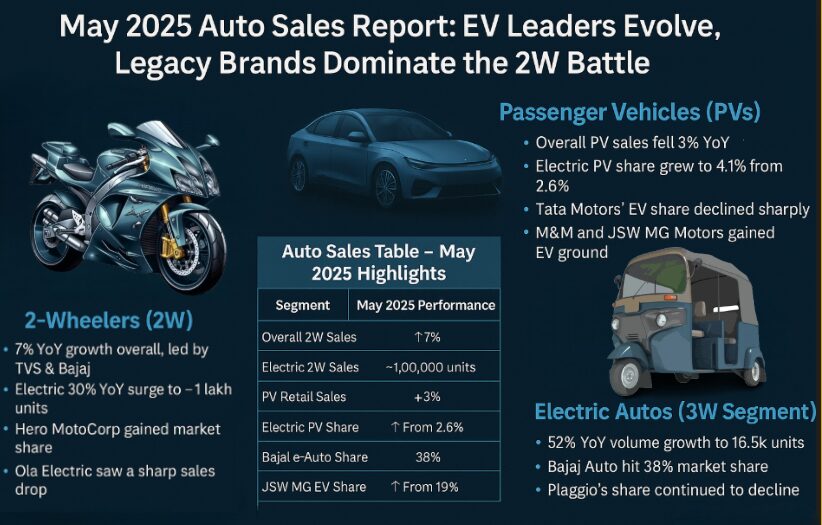

- 2-Wheelers (2W) See Modest Growth, E2Ws Surge

- 7% YoY growth overall in 2W retail sales

- Electric 2W sales hit ~1 lakh units, growing 30% YoY

- TVS Motors and Bajaj Auto maintained dominance, while Hero MotoCorp gained traction

- Ola Electric saw a dramatic drop in sales

- Passenger Vehicles (PVs) Witness Dip, EVs Pick Up Pace

- Overall PV retail sales down 3% YoY

- Electric PV penetration rose to 4.1%, up from 2.6% last year

- Tata Motors lost EV market share significantly

- M&M, JSW MG, and Hyundai gained thanks to fresh EV launches

- 3-Wheeler Segment: e-Autos on the Rise

- e-Auto sales grew 52% YoY to 16.5k units

- Bajaj Auto climbed to 38% market share

- Piaggio’s share declined to just 6%

- Electric Vehicle (EV) Ecosystem – New Winners, Lost Crowns

- JSW MG’s Windsor EV drove a jump in market share from 19% to 31%

- M&M’s BE 6 and XEV 9E SUVs gained popularity

- Tata’s EV leadership shrunk from 66% to 35%, but the new Harrier EV may change that

Introduction: India’s Auto Sector Is Entering a New Era

May 2025 has been a mixed bag for India’s automobile industry. From a modest surge in 2-wheeler sales during the northern wedding season to electric vehicles gaining serious traction, the month signals a deepening shift towards electrification. While legacy giants like TVS and Bajaj Auto continue to rule the electric 2-wheeler space, the passenger EV segment is now buzzing with new frontrunners like JSW MG and Mahindra.

As highlighted in the latest auto tracker released by Equirus Securities, the competitive landscape is evolving, and India’s EV transition is beginning to mature — with innovation, pricing, and new launches taking center stage.

About Equirus Securities

Founded with the mission to put “client first, always,” Equirus Securities is one of India’s leading financial services firms. With expertise across investment banking, wealth management, insurance, and institutional securities, Equirus has successfully managed 295+ deals across sectors and raised over $13 billion in the last 17 years. Their monthly auto sales tracker has become a trusted pulse-check for India’s rapidly changing auto market — offering deep insights to investors, analysts, and auto enthusiasts alike.

Segment-Wise Breakdown: May 2025 Auto Story

2-Wheelers (2W)

The overall 2W segment showed healthy YoY growth of 7%, thanks to seasonal factors like weddings in North India. But it’s the Electric 2-Wheeler (E2W) space where action peaked — reaching nearly 1,00,000 units and rising 30% YoY.

- TVS Motors retained its crown with 24.5% market share, driven by aggressive pricing, wider network reach, and battery upgrades.

- Bajaj Auto followed closely at 21.7%, keeping its stronghold intact.

- Hero MotoCorp, often considered a late entrant in the EV space, grew its share to 7.1%, thanks to its affordable Vida V2 line.

- Ola Electric, however, faced a serious setback, with its market share nosediving from 48.3% to 18.4% YoY — a sign of the increasing pressure in a maturing market.

Passenger Vehicles (PV)

Traditional car sales fell 3% YoY, with only North and East India showing marginal growth. The silver lining? Electric Passenger Vehicles (E-PVs).

- EV penetration rose to 4.1%, supported by new launches and regional awareness.

- Tata Motors, the early leader, saw a dip in market share to 35% from 66% last year.

- JSW MG Motors surged with its Windsor EV, now capturing 31% of the market.

- Mahindra’s BE 6 and XEV 9E, along with Hyundai’s e-Creta, contributed to the EV growth narrative.

Electric Autos (3W Segment)

Electric 3-wheelers are quickly replacing traditional fuel models.

- e-Auto sales grew 52% YoY in May 2025.

- Bajaj Auto, which entered the segment in June 2023, has expanded rapidly — now at 38% share.

- M&M holds steady at 38–40%, while Piaggio, once a significant player, dropped to just 6%.

Auto Sales Table – May 2025 Highlights

| Segment | May 2025 Performance | YoY Change |

|---|---|---|

| Overall 2W Sales | ↑ 7% | Seasonal demand boost |

| Electric 2W Sales | ~1,00,000 units | ↑ 30% |

| PV Retail Sales | ↓ 3% | Mixed regional performance |

| Electric PV Share | 4.1% | ↑ From 2.6% YoY |

| Bajaj e-Auto Share | 38% | ↑ From 22% YoY |

| JSW MG EV Share | 31% | ↑ From 19% YoY |

| Tata EV Share | 35% | ↓ From 66% YoY |

Conclusion: The Market Is Getting Smarter and Sharper

May 2025 serves as a reminder that the Indian automotive market is fast transitioning from a fuel-driven economy to an electrified future. With legacy brands still going strong in the 2W segment, and new-age brands and fresh models shaking up the PV space, the game is getting more competitive, and the consumer is winning.

This transition also highlights a deeper trend — EV adoption isn’t about brand loyalty anymore; it’s about innovation, pricing, availability, and smart features. The coming months will reveal whether Tata can bounce back, Ola can regroup, and whether JSW MG and Mahindra can maintain their new-found momentum.