Buying a car is like a big checklist item for most people. People aspire to have the latest and modern cars in their garage. Some even dream of owning cars right from their childhood. Turning that dream into a reality is going to get a little more difficult as the car prices are going to touch an all-time high in the coming months. We have already seen car manufacturers increasing the prices once in Jan’21, then again in Apr’21 and they are set to increase them again for the third time in this calendar year.

Reality Check

Now, one might say that the demand for cars has gone up since people are purchasing new cars to avoid using public transport. Even though that is true, the manufacturers are actually not making enough profits. The revenue is going up but the profit margins are going down.

For e.g. let’s take Maruti Suzuki, India’s largest PV manufacturer’s financial results. In Q4 FY’21 (Jan’21 to Mar’21) Maruti Suzuki posted revenue of ₹24,043 Cr. and a net profit of ₹1,166 Cr. which is about 4.8% of the total revenue however in Q1 FY’22 (Apr’21 to Jun’21) they reported total revenue of ₹17,770 Cr and a net profit of ₹440 Cr. which equates to 2.47% of the revenue. The profit % has dropped by almost 50% which is really huge.

Well, people have been raving over Tata Motors’ success and how the sales of Tata cars have increased thanks to the “VocalforLocal” sentiment. Here’s the real picture – Tata Motors posted total revenue of ₹20,045 Cr and a net profit of ₹1,645 Cr at 8.2% in Q4 FY’21 whereas, they reported total revenue of ₹11,904 Cr and a loss of ₹1,320 Cr which is a whopping 11% loss in Q1 FY’22.

We have just studied these two manufacturers as of now and the findings are enough to understand what is going on and what we might see in the future.

Why Is This Happening?

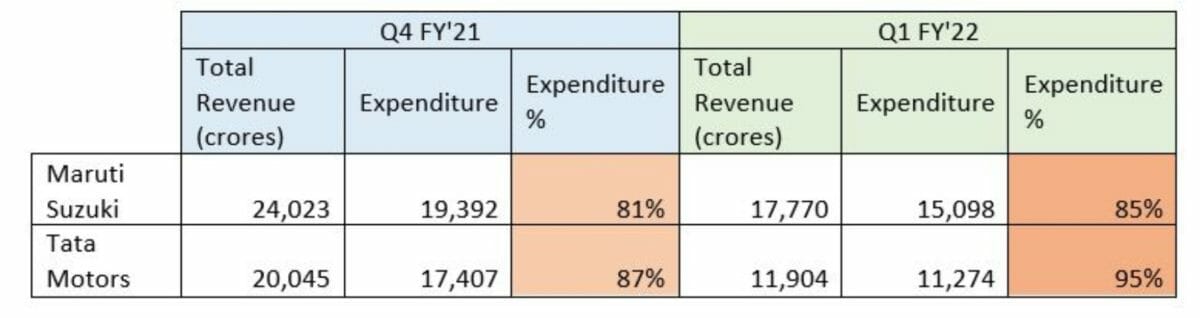

The rule of thumb is that the profits will decrease if the input costs increase and vice versa. Despite the best efforts by the manufacturers to reduce the input cost, the cost of raw materials keeps on moving northwards. The below table will explain how the input costs have affected the profit margins of both these manufacturers.

The expenditure includes Consumption of Raw Materials, Purchase of Traded Goods, Employees Cost, Fuel, etc. We have not included excise duties and taxes as they do not count towards production costs. It is clearly visible that the companies are paying more towards the production of the vehicles.

Shortage Of Resources

Since the globe was hit with the pandemic, mining, production of raw materials, etc had come to a standstill and the industries are still struggling to cope with the sudden demand. Demand is high and supply is low and as per the law of economics, the cost of procurement has gone up.

Steel which is one of the most important components in building a car is almost 215% more expensive than it was in Mar’20 before the world went into a lockdown. Copper which is the major component in electrical wiring has also reached its lifetime high price. Secondly, there is a worldwide shortage of semiconductors that are used in the electronics of vehicles which has also resulted in the price hike of semi-conductors. Not only this, other resources like rubber, aluminium, plastics have all seen a rise in their costs. The rise in fuel prices is also adding fuel to the fire. All these factors are responsible for the increase in the cost of production of the vehicles.

We only saw Maruti and Tata as an example for this case study however, the story remains the same for all other manufacturers. One by one they are all increasing the prices of their products by 1%-5%. We should expect another round of price hikes just before the festive season if the situation does not improve.