4-Point Overview:

- Domestic 2-wheeler sales dropped sharply by 16% in June 2025

- Export demand surged, with CV exports growing nearly 50%

- Overall June sales just edged out last year by 1%

- Quarterly exports helped cushion weak domestic sales

Introduction:

Bajaj Auto’s latest sales numbers paint a contrasting picture. On one side, the Indian market continues to feel the pinch with shrinking domestic two-wheeler sales. On the other, exports are powering ahead, especially in the commercial vehicle space. Let’s dive into the numbers and see how Bajaj’s global game might be what’s keeping things steady, even as the domestic scene cools off a bit.

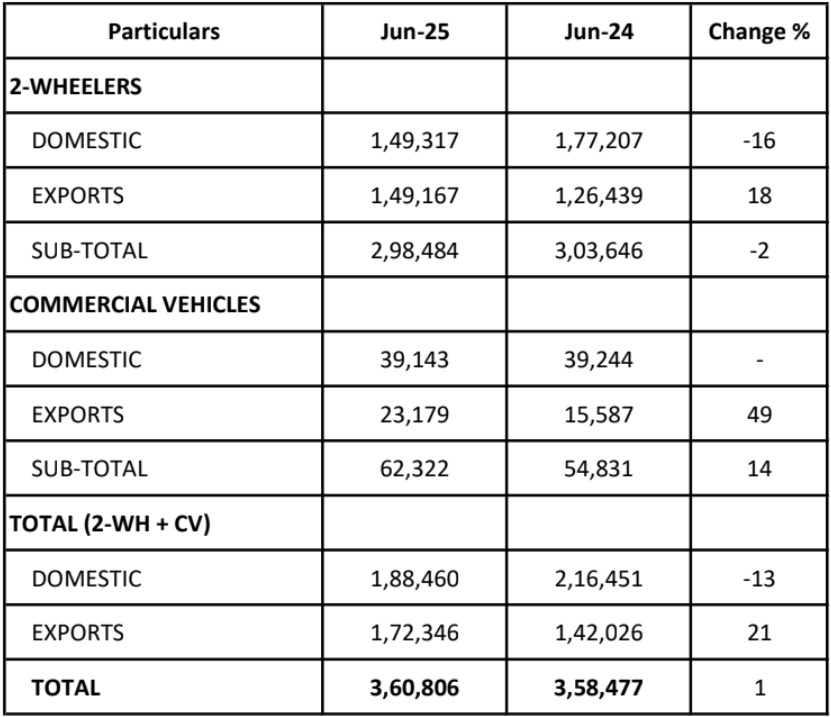

June 2025: A Mixed Bag

June wasn’t exactly a high point for Bajaj’s local two-wheeler business. Sales fell by 16% compared to June 2024, translating to over 27,000 fewer units sold in India. That’s a significant drop, pointing to either softening rural demand, market saturation, or rising cost sensitivities.

But here’s the bright side: exports soared. Bajaj shipped out 1,49,167 two-wheelers overseas—a sharp 18% jump from last year. Even more impressive was the 49% spike in commercial vehicle exports, suggesting robust traction in international markets

Monthly Sales Snapshot:

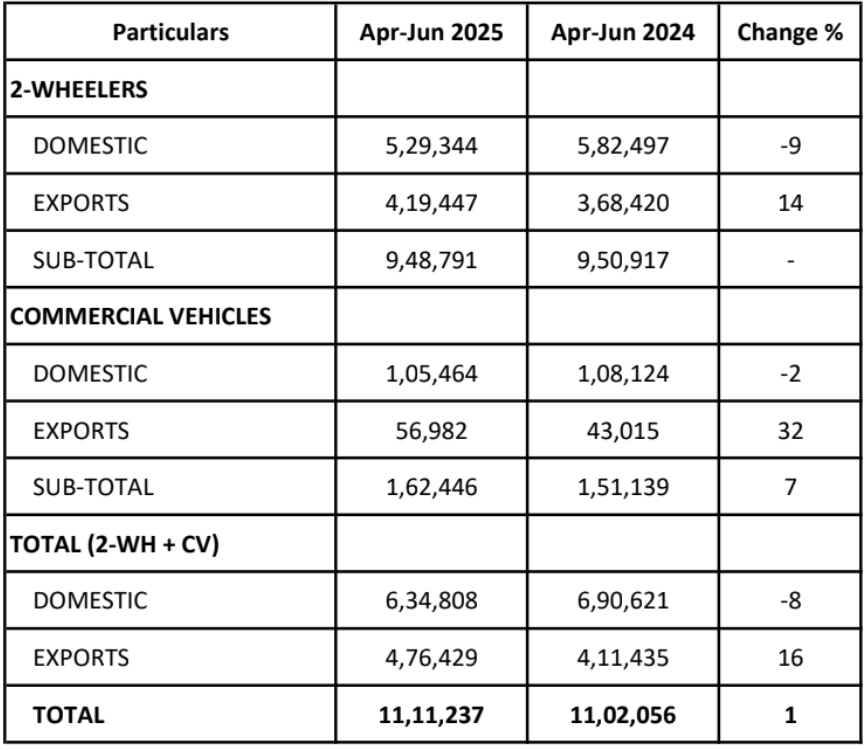

Q1 FY26: A Look at the Quarter

Zooming out to the April–June 2025 quarter, we see the same pattern play out. While domestic sales slipped by 8%, exports rose a reassuring 16%, keeping overall volumes in the green with a 1% YoY growth. It’s evident now that Bajaj’s bets on international diversification are starting to pay off in tangible ways.

The bigger boost came from CV exports, which jumped 32% compared to Q1 last year. This aligns with Bajaj’s strategy of strengthening presence in last-mile mobility solutions abroad.

Quarterly Sales Snapshot:

What’s Driving the Export Boom?

There’s more than just strong demand driving Bajaj’s export story. A few key factors stand out:

- Cost competitiveness: Bajaj’s products offer good value in emerging markets.

- Global alliances: The company has nurtured strong dealer networks in Africa, LATAM, and South Asia.

- Product mix: The compact CV lineup is finding increased utility in urban and rural transport needs globally.

Bajaj’s adaptability to market needs, especially in terms of emissions compliance and cargo/passenger versatility, is giving it an edge internationally—even as the domestic market battles inflation and sentiment concerns.

Conclusion: Holding Ground with Global Grit

While Bajaj Auto faces clear headwinds in India, the strength of its global operations is becoming the cushion it needs. The next challenge? Reigniting domestic demand while continuing to deepen its global presence. If it can find that balance, FY26 might just turn into a year of quiet resilience—and maybe even quiet success.