Overview

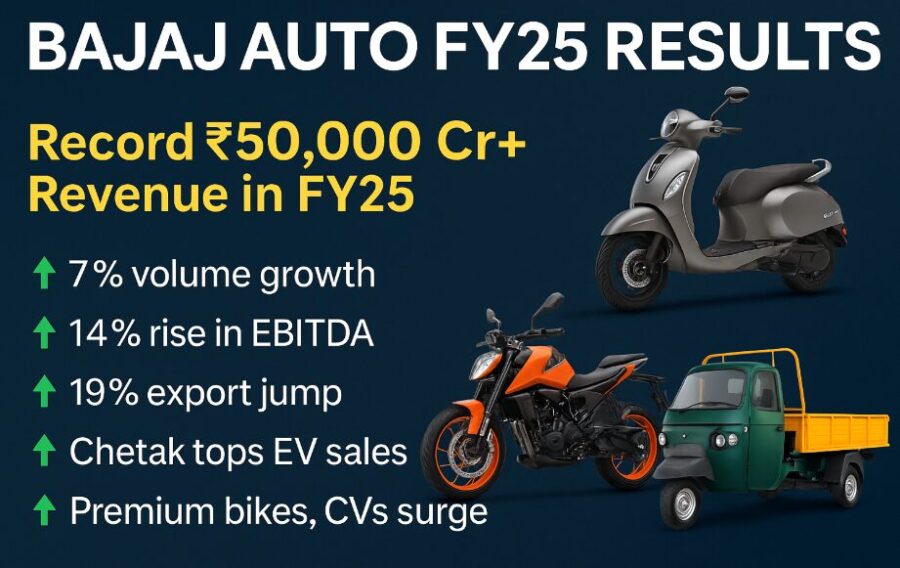

- All-Time High Revenues: Bajaj Auto crosses ₹50,000 + crore in annual revenue for the first time, growing 12% YoY.

- EV Leadership Cemented: Chetak emerges as India’s No.1 electric scooter, with volumes doubling and market share up 1,400 bps.

- Exports Rebound Strongly: FY25 exports see 14% growth, with Q4 volumes up 20% YoY.

- Record Profitability: PAT crosses ₹8,000 crore mark, with EBITDA margin held steady at 20.2%.

Introduction

Bajaj Auto has concluded FY25 on a high note, setting new records across revenue, profit, and electric vehicle (EV) growth. Despite global headwinds and domestic moderation in H2, the company’s agile strategy, product innovation, and robust exports helped it navigate market volatility. With electric mobility picking up pace and Pulsar continuing to dominate, Bajaj Auto’s FY25 performance stands as a testament to its resilient and forward-looking business model.

FY25 Financial Performance: New Peaks in Revenue and Profit

Bajaj Auto’s standalone revenue hit an all-time high of ₹50,010 crore in FY25, up 12% from ₹44,685 crore in FY24. This surge was led by record volumes and strong sales of both ICE and electric vehicles.

Table: Standalone Financial Summary (₹ Crores)

| Metric | FY25 | FY24 | YoY Change |

|---|---|---|---|

| Turnover | ₹51,431 | ₹46,088 | 12% |

| Revenue from Operations | ₹50,010 | ₹44,685 | 12% |

| EBITDA | ₹10,101 | ₹8,825 | 14% |

| EBITDA Margin | 20.2% | 19.7% | +40 bps |

| Profit Before Tax | ₹11,052 | ₹9,822 | 13% |

| Profit After Tax (normalized) | ₹8,363 | ₹7,479 | 12% |

Despite margin-diluting EV sales doubling, Bajaj maintained a healthy EBITDA margin of 20.2%, showcasing its pricing discipline and improved dollar realization on exports. The company also added ₹6,500 crore in Free Cash Flow and maintained ₹17,000 crore in surplus funds.

EV Revolution: Chetak Charges to the Top

FY25 marked a pivotal year for Bajaj Auto’s electric journey. The Chetak became India’s best-selling electric scooter, with market share rising 900 basis points YoY. The introduction of the new Chetak 35 series played a critical role, accounting for 60% of Q4 sales and enabling a 2x YoY growth in volume.

The company’s electric business generated over ₹5,500 crore in revenue—contributing nearly 20% of the domestic business, backed by a robust 4,000+ touchpoint network and a full PLI-certified portfolio.

Exports Power Growth: LatAm and Asia Lead the Charge

After a soft H1, exports bounced back sharply in H2 FY25. Annual export volumes grew 14%, contributing significantly to revenue stability.

Table: Export Volume Summary

| Segment | FY25 | FY24 | YoY Change |

|---|---|---|---|

| Two-Wheelers | 16,74,060 | 14,77,338 | 13% |

| Commercial Vehicles (CV) | 1,89,221 | 1,58,872 | 19% |

| Total Exports | 18,63,281 | 16,36,210 | 14% |

LatAm delivered record volumes for the second year, and Asia recovered strongly, mitigating lower KTM exports due to temporary restructuring suspensions.

Domestic Business: Leadership in ICE and EVs

Despite H2 slowdown, Bajaj Auto’s domestic business ended the year with its highest-ever revenue, growing 12% YoY.

- Motorcycles: Pulsar continued its reign, generating ₹10,000+ crore in domestic revenue and over ₹15,000 crore globally. Notably, the new Freedom motorcycle became a ₹500 crore brand within just five months of launch.

- Commercial Vehicles: Revenues crossed ₹10,000 crore, with e3W volumes growing 4x YoY. The launch of the GoGo brand, aimed at superior range and lower maintenance, is set to drive future growth.

- Premium Segment: KTM-Triumph duo sold ~1 lakh units domestically. Triumph volumes alone doubled, aided by expanded reach and successful new launches like Speed T4.

Q4 FY25: Sustained Momentum Amid Tactical Shifts

Bajaj Auto’s Q4 performance reflects its operational strength and market adaptability.

Table: Q4 FY25 vs Q4 FY24 Financials (₹ Crores)

| Metric | Q4 FY25 | Q4 FY24 | YoY Change |

|---|---|---|---|

| Revenue from Operations | ₹12,148 | ₹11,485 | 6% |

| EBITDA | ₹2,451 | ₹2,307 | 6% |

| Profit After Tax | ₹2,049 | ₹1,936 | 6% |

| EBITDA Margin | 20.2% | 20.1% | +10 bps |

Q4 exports rose 20% YoY in volume, aided by strong demand in Africa, LatAm, and Asia. However, KTM export suspension temporarily impacted revenues. Domestically, commercial vehicle growth was powered by GoGo’s launch, and early signs of a motorcycle recovery are visible post pricing interventions.

Dividend & Shareholder Value

Bajaj Auto’s strong financials translated to generous shareholder rewards. The Board recommended a final dividend of ₹210 per share, amounting to ₹5,864 crore—a 72% payout of FY25 profits.

Conclusion: Building the Future on a Strong Foundation

FY25 has been a defining year for Bajaj Auto. From record-breaking revenue and profit to a commanding position in India’s electric two-wheeler market, the company demonstrated agility, innovation, and resilience. With Chetak leading the EV transition, exports gaining strength, and premium offerings expanding, Bajaj Auto is not just riding the wave—it’s shaping the future of mobility.

As FY26 begins, all eyes are on how Bajaj builds on this momentum, especially with its upcoming launches and expansion plans across emerging markets and EV platforms.