The government’s GST council held its 50th meeting on Tuesday to provide a clearer definition of Utility Vehicles (UVs) and Sport Utility Vehicle (SUV). The previous definition had some uncertainty, which allowed certain models to avoid the higher compensation cess imposed on SUVs.

Previously, as decided in the GST Council’s 48th meeting in December 2022, vehicles meeting four criteria would attract a higher compensation cess of 22 percent in addition to the 28 percent GST on petrol and diesel vehicles. The criteria included engine capacity exceeding 1,500cc, length exceeding 4,000mm, ground clearance exceeding 170mm, and being commonly known as an SUV.

This definition had a potential loophole where vehicles not specifically labeled as SUVs, such as Multi-Utility Vehicles (MUVs) or Crossover Utility Vehicles (CUVs), could bypass the UV classification and attract a lower cess, even if they met the other three criteria.

During the December meeting, some state representatives voiced concerns and requested clarification on this matter. They suggested removing the fourth criterion entirely, but this raised concerns about misclassifying sedans as UVs. The council agreed to conduct further studies and reassess the definition at a later stage.

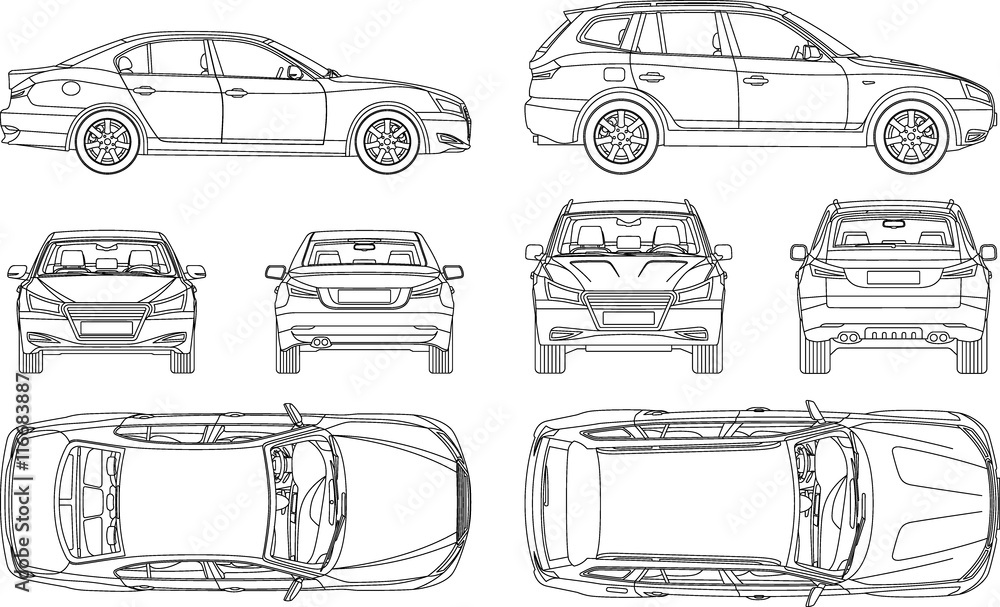

In the recent meeting, the council clarified the definition by stating that the 22 percent compensation cess would only apply to UVs, including SUVs, MUVs, and crossovers that meet three criteria: engine capacity, length, and ground clearance. It’s worth noting that high-riding sedans with ground clearance exceeding 170mm are exempt and will not be considered as UVs.

Official Statement

Finance Minister Nirmala Sitharaman stated, “There was a request to rationalize the 20 percent and 22 percent taxation, so that everything is taxed at 22 percent. However, we didn’t go with that recommendation because it would include sedans, and two states specifically objected to including sedans.”

This means that all sedans, regardless of their length, will attract a lower compensation cess. Sub-four-metre vehicles, as well as midsize SUVs and MPVs with engine capacities below 1,500cc, will also attract a lower compensation cess. Large UVs with hybrid powertrains will attract a 15 percent cess instead of 22 percent.

In summary, vehicles meeting the three parameters of length exceeding 4,000mm, engine capacity exceeding 1,500cc, and unladen ground clearance of 170mm and above can be defined as UVs, regardless of their specific name or label and will attract a higher SUV tax.